5 Tips for Claims Adjusters on Filling Out the Consent Form

Content under revision: Amendments to the Act respecting the protection of personal information in the private sector effective on September 22, 2023. Stay on the top of the changes by consulting La ChADExpress newsletter and our LinkedIn page.

If a claims adjuster is unable to obtain personal information from an individual while conducting his or her investigation, the adjuster must obtain the individual’s consent before gathering the information from a third party.[1] For example, you must obtain the insured-claimant’s consent if you wish to review their claims history in the Fichier central du Groupement des assureurs automobiles (GAA) [the Central Registry of the GAA] or if you wish to obtain an incident report from the police.

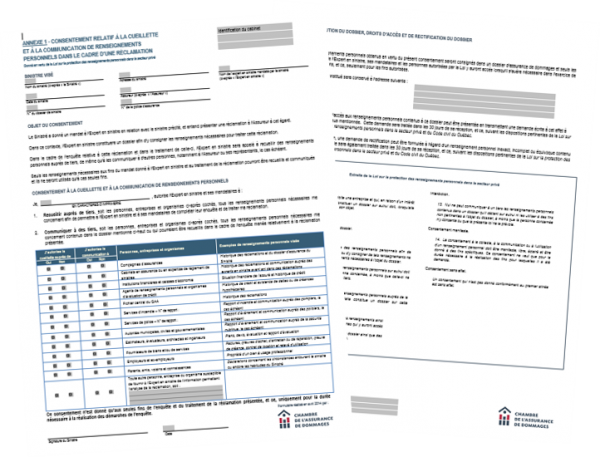

However, you must not only obtain consent: you must also ensure that the verbal or written consent you received from all concerned parties (claimants, insureds, third parties) is documented in the client-file before collecting, using or communicating their personal information. The Chambre de l’assurance de dommages (ChAD) strongly recommends using the Consent form for the collection and communication of personal information when making a claim in order to facilitate the adjuster’s work, protect the various concerned parties, inform insureds of their rights, respect your legal and ethical obligations, as well as centralize within a single document all the relevant information on how the consent was obtained and the information collection process. Two forms are available, one for adjusters mandated or employed by an insurer, and the other for adjusters mandated by insureds [in French only].

Here are five tips on filling out the form.

1. If the insurance contract is in the name of more than one insured, you must also obtain consent from the co-insureds. It is preferable to fill out a consent form for each of the co-insureds.

2. If the questionnaire is filled out by a third party rather than by the insured him/herself, make sure that the questionnaire itself does not contain any personal information concerning the insured, which could inadvertently be passed on to the third party. For example, if you have the form signed by a neighbour who may have suffered damages that you will also have to assess, make sure that you do not disclose confidential information to him, such as your insured’s policy number. In the first section of the form, you may, however, note the date and the location of the loss, as well as the claim file number.

3. You must never automatically check off all the boxes in the “Consent to the collection and communication of personal information” section of the form. This is a violation of the Act respecting the Protection of personal information in the private sector[2] and the Code of ethics of claims adjusters.[3] It is your responsibility to determine the issues or information required for the purposes investigating and processing the claim.

Formulaire de consentement relatif à la cueillette et à la communication de renseignements personnels dans le cadre d’une réclamation

4. In the section entitled “Consent to the collection and communication of personal information,” if you check off “Any other person, enterprise or organization likely to provide the Insurer with information that will help in analyzing the claim,” you must identify exactly who they are in the space provided for this purpose.

5. The second page of the form specifies the right granted to the person concerned, such as the right to access and rectify his or her file. This page is important, since you have an obligation to communicate this information. You must also indicate the address where the file will be kept. Finally, it is recommended that you give a copy of the completed and signed form to the person concerned. .

What should I do if the insured refuses to sign the form?

Though obtaining consent is mandatory, written consent is not required. When verbal consent is given, make sure to note in the file all the information given to the insured pursuant to the ARPPIPS,[4] including the purpose for collecting this personal information, how the information will be used, the categories of individuals within the company who will have access to it, the place where the file will be kept, and the rights of access and rectification.

To assist you, the ChAD provides it members with a procedure, as well as two standard forms—one for adjusters mandated or employed by an insurer and the other for adjusters mandated by insureds [in French only].

For further information, do not hesitate to take Renseignements personnels lors d’un sinistre : comprendre, utiliser et expliquer le formulaire de consentement (AF1020) [Personal information and claims: understanding, using and explaining the consent form (AF 1020), [in French only], a course given by Me Ingi Khouzam on ÉduChAD.

[1] Section 6 of the Act respecting the Protection of personal information in the private sector.

[2] Section 5 of the Act respecting the Protection of personal information in the private sector.

[3] In particular, sections 10, 22, 23 and 58.1 of the Code of ethics of claims adjusters.

[4] Section 8 of the Act respecting the Protection of personal information in the private sector.