What is the co-insurance clause?

The co-insurance clause is a calculation method used to determine the amount of insurance sufficient to cover the cost of replacing one’s insured property. Agents and brokers must explain the co-insurance clause to their clients and warn them of the risks of being underinsured. Only then will they be able to make an informed choice.

Since the best explanations often make use of concrete examples that include illustrations and numbers, we have created a fact sheet for insureds to explain how the clause works. We encourage you to share it with your clients. Take some time to review the fact sheet’s explanations and calculations with them to help them understand how the clause applies to their situation.

This web page is a tool to assist you in your professional practice. It includes explanations and examples to help you fully explain this calculation in layman’s terms.

The co-insurance clause: proportional indemnity in the event of underinsurance

Article 2493 of the Civil Code of Quebec provides for the application of a co-insurance clause. Under this article, if the amount of coverage is less than the full value of the insured property (100%), the insurer might only pay a proportional indemnity in the event of a partial loss.

Example

If a building is worth $500,000 (cost of rebuilding) but is only insured for $250,000 (50% of its value), a loss causing $200,000 in damages (partial loss) would entitle the insured to compensation of 50%, in other words $100,00, even though the total amount of insurance is $250,000.

The co-insurance clause in insurance contracts

Certain contracts, in particular in commercial-lines insurance, include a co-insurance clause (“règle proportionnelle ” in French) that changes the “100% by default” rule to a requirement of at least 80% or 90%. This means that the amount of insurance purchased must be at least 80% or 90%, as the case may be, of the insured property’s value to avoid the client being penalized in the event of a partial loss. Concretely speaking, this leaves some leeway and thus benefits the insured, who will not be penalized (in the event of a partial loss) if their property is not insured for 100% of its value.

In Quebec, personal-lines home insurance contracts no longer usually include such clauses. In the absence of a specific clause, the general rule applies, in other words a co-insurance clause of 100%.

Replacement cost clauses, often called guaranteed (or improved) replacement cost, make up, at least in part, for a potential gap between the insured value and the cost of rebuilding, as long as the conditions stipulated in the contract have been met.

Respecting the co-insurance clause – required amount of insurance

If the amount of insurance purchased complies with the percentage stipulated in the contract’s co-insurance clause, the insured will receive an indemnity covering the full cost of the loss in the event of a partial loss, even if the property is not insured for its full value.

This coverage can prove particularly important for condominiums (co-ownerships): cases where partial losses are not fully compensated could lead to unfortunate financial consequences for the syndicate of co-ownership and, by extension, all the co-owners.

Impact of the co-insurance clause on the indemnity

Your clients must understand that this clause may limit the indemnity paid in the event of a partial loss. Please draw their attention to these two crucial points.

1. In the event of a total loss, if the amount of insurance stipulated in the contract is less than the value of the insured property or the building (underinsurance), the indemnity paid in the event of a loss will be limited to the insured amount and may not cover the full amount of the damages.

Example

A building worth $400,000 is insured for $300,000. In the event of a total loss, compensation would only amount to $300,000, in other words, the limit of insurance. It is therefore advisable to choose an amount of insurance that is equal to the value of the insured property or to its replacement cost, if the insured’s contract includes a replacement cost clause.

2. In the event of a partial loss, the co-insurance clause will come into play; it will be used to determine the indemnity the insured is entitled to. In order to receive an indemnity that covers the full amount of damages when a partial loss occurs, your clients must insure their property for the minimum amount corresponding to the value of the insured property, or, where appropriate, the percentage stipulated in the co-insurance clause—generally 80% or 90%.

If the client does not respect the percentage required under the co-insurance clause (the building is not insured for the minimum amount required pursuant to the clause), he or she will receive a lower indemnity and will have to assume part of the cost of damages, even if the amount of insurance purchased was sufficient to fully indemnify the partial loss suffered.

Calculating a sufficient amount of insurance

To calculate the amount of insurance required and the compensation paid according to the different percentages, let’s go back to our example.

- Building worth $400,000;

- Insured for $300,000, in other words, 75% of its value;

- Loss resulting in $200,000 worth of damages.

Amount of insurance required

- If the co-insurance clause stipulates 100%, the building must be insured for 100% of $400,000, in other words, $400,000. Otherwise, the insured will be penalized in the event of a partial loss.

- If the co-insurance clause stipulates 90%, the building must be insured for 90% of $400,000, in other words $360,000, in order to ensure that the insured is not penalized in the event of a partial loss.

- If the co-insurance clause stipulates 80%, the building must be insured for 80% of $400,000, in other words $320,000, in order to ensure that the insured is not penalized in the event of a partial loss.

If the building is insured in accordance with the percentage required under the co-insurance clause, the insured will receive the full amount of compensation in the event of a partial loss, up to the amount insured.

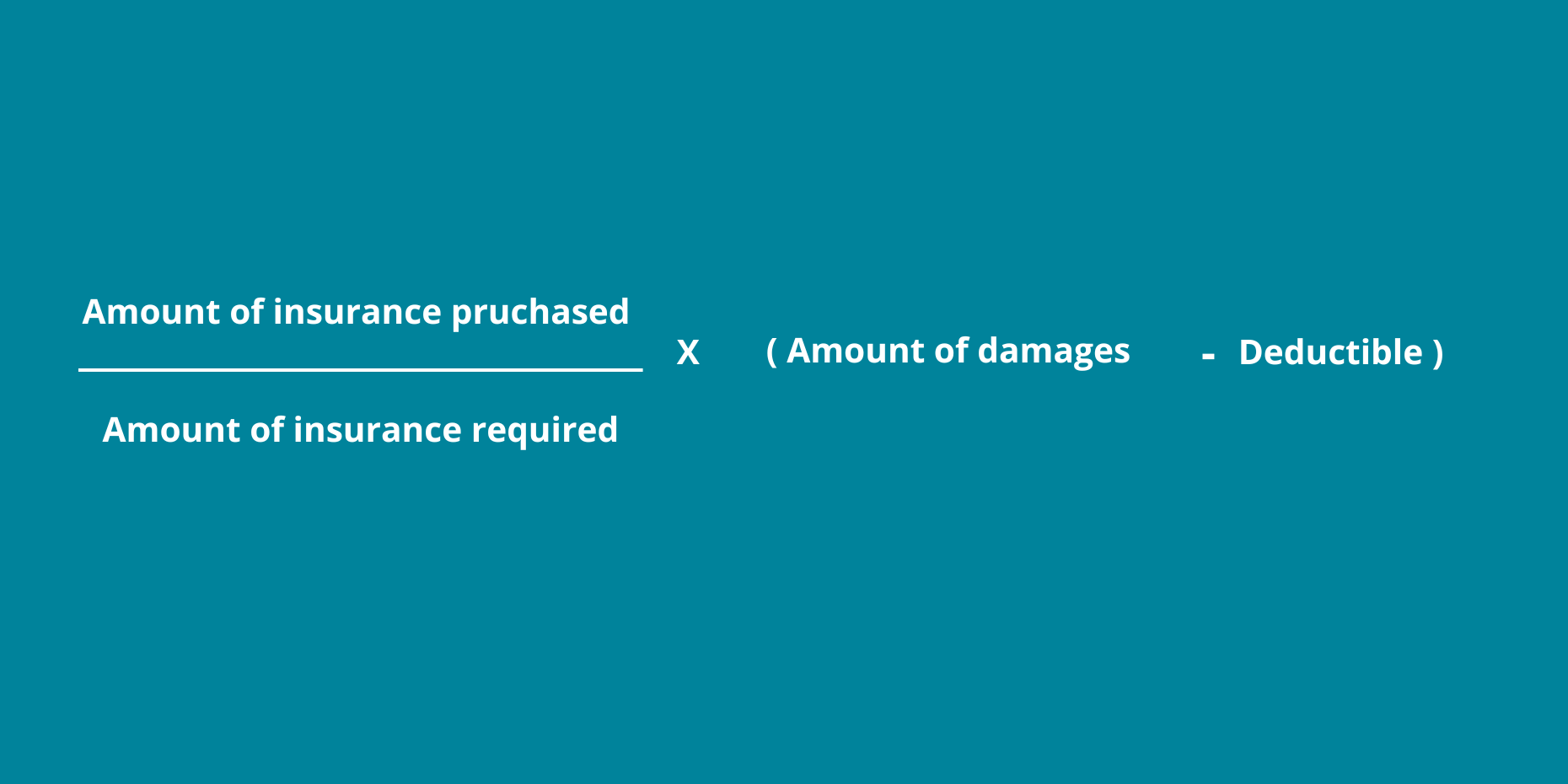

Calculating the co-insurance clause

The proportional indemnity is calculated as follows:

In our example, the value of the insured property is $400,000, the insured amount is $300,000, and the partial loss is $200,000. If the insured amount does not comply with a co-insurance clause of 100%, 90% or 80%, as the case may be, the client will be entitled to the following indemnity (assuming a $1,000 deductible:

As you can see, in cases of underinsurance, the percentage of the co-insurance clause has a major impact on the amount of compensation the insured is entitled to.

Fact sheet to be given to the customer

This sheet includes:

- The consequences of non-compliance with the co-insurance clause.

- An explanatory table