Co-Ownership

Co-ownership insurance is a complex field. To understand it well, you must stay informed and take every opportunity to further your knowledge. The sources of information on co-ownership in the links, documents and tools below will better equip you to advise your clients, help them choose the right products and support them when making a claim.

The information on this page applies to divided co-ownerships. Insurers generally consider undivided co-ownerships to be any other type of housing that has a number of owner-occupants. For more information on undivided co-ownerships, contact the insurer to learn about their underwriting standards and discuss your clients’ specific needs.

Description of private portions / reference unit

“The syndicate keeps at the disposal of the co-owners a register containing […] a description of the private portions that is sufficiently precise to allow any improvements made by co-owners to be identified. The same description may be valid for two or more portions having the same characteristics. [LW1]Puisqu’il s’agit d’une citation de l’article.” – Article 1070 of the Civil code of Québec.

It is not your responsibility to write up a description of the private portions; this responsibility lies with the syndicate of co-owners. This description is, however, one of the documents you will need to accurately evaluate your clients’ needs and advise them properly.

You can suggest your clients use the Insurance Bureau of Canada’s (IBC) model to help them do this.

The description allows you to identify improvements the co-owners have made over the years, and in the event of a loss, it helps avoid any confusion over what the syndicate’s insurance covers (all immovable property, including private portions) and what constitutes an improvement (covered by the co-owner’s insurance).

Indeed, if there is no description of the private portions, the units could be considered to not have undergone any improvements and the insurer could be required to compensate the syndicate for restoring the private portions to the condition they were in on the day of the loss. The insured value of the building does not usually take into consideration improvements the co-owners have made to their private portions over the years; the amount of insurance might therefore be insufficient. Furthermore, if a partial loss occurs, the co-insurance clause might come into play, resulting in the syndicate receiving lower compensation than the actual cost of the damages.

Important

As damage insurance agents and brokers, you should ask your clients (be they syndicates or co-owners) for a copy of this description to help you properly evaluate or re-evaluate their needs and the coverages required.

As claims adjusters, you should also ask for a copy of the description of the private portions (or the description of the reference unit) to identify any improvements the co-owners have made that have increased the unit’s value.

Amount of insurance and evaluation

“The syndicate has an insurable interest in the whole immovable, including the private portions. It shall take out insurance against ordinary risks providing for a reasonable deductible and covering the whole of the immovable, except improvements made by a co-owner to his portion, where they can be identified in relation to the description of that portion. The amount insured must cover the reconstruction of the immovable in accordance with the standards, usage and good practice applicable at that time; the amount must be evaluated at least every five years by a member of a professional order designated by government regulation. » – Article 1073 of the Civil Code of Québec

Evaluation of the cost of rebuilding the co-ownership every five years

Every five years, the syndicate of co-owners must mandate a member of the Ordre des évaluateurs agréés du Québec3 to carry out an evaluation of the building’s reconstruction cost.

The Ordre des évaluateurs agréés du Québec, in collaboration with the IBC and the ChAD, has revised the list of elements to include when conducting an evaluation for insurance purposes mandated by the syndicate of co-owners [in French only]. Ask the syndicate for a copy of this evaluation. If you notice that certain elements are missing, discuss this with the syndicate’s representatives, and explain to them the legal requirements and potential impacts on the syndicate’s insurance.

You can explain to your client that the value of reconstruction corresponds to the cost of rebuilding the entire building, including demolition costs, landscaping, bringing everything up to code, professional fees, labour costs, and taxes. Make sure to stress the importance of proper coverage in the event of a major loss. You can also explain to your client the coinsurance clause, which would apply in the event of a partial loss. And finally, remind your client that an insurer could refuse to insure the risk if it finds that the syndicate does not plan to purchase insurance to cover the full cost of reconstruction.

Important

Agents and brokers: ask for a copy of the evaluation report and advise your client appropriately by making recommendations based on the evaluation.

Claims adjusters: the evaluation report on the cost of rebuilding the property could contain valuable information on the category of the building, the quality and type of materials used and other information regarding the building’s construction; ask for a copy.

Mandatory coverages for the syndicate of co-owners

The Regulation to establish various measures in matters of divided co-ownership insurance stipulates that the syndicate’s property insurance contract must include the following risks:4 theft, fire, lightning, storms, hail, explosions, water leak damage, sewer backup and overflows from appliances connected to water distribution piping within the building, strikes, riots or civil disturbances, the impact of an aircraft or vehicle, and vandalism or malicious acts.

The syndicate must also “take out third person liability insurance for itself and for the members of its board of directors and the manager as well as for the president and the secretary of the general meeting of the co-owners and the other persons responsible for seeing to its proper conduct.”5

Important

Agents and brokers: verify and, if need be, suggest adjustments to the coverages included in the contracts of your syndicate of co-owners clients.

Co-owners insurance

Each co-owner must take out liability insurance for at least one million dollars if the immovable has fewer than 13 fractions and two million dollars if it has 13 or more fractions.6

The syndicate’s insurance is the primary insurance7 and the amounts assumed by the syndicate to repair damages must be divided (apportioned) among the co-owners, in particular when the repairs are inadmissible under the terms of the contract (absence of insurance or insufficient insurance) or if the syndicate has chosen not to file a claim for the loss.

Co-owners can nevertheless file a claim with their insurer for the portion of the damages that was not covered due to an absence of insurance or insufficient insurance.8 However to do so, the co-owners’ coverage must include the Extension of Coverage – Loss Assessment rider. They must also have purchased the appropriate coverages; to learn more about this topic, please read Le refoulement d’égout, exclusif au rez-de-chaussée? [Sewer backup, only for the ground floor? in French only.]

Important

You play an important part in informing insureds of the risks they are exposed to, as well as the available coverages9, the exclusions and the limits. To be able to advise your clients appropriately, you must start by asking questions that allow you to understand their needs.10 Furthermore, if an insured refuses an endorsement, it is your responsibility to explain to him the consequences of this decision and to note your file accordingly.11

The syndicate of co-owners’ deductibles: your advisory role

As you are aware, the deductible can significantly impact the cost of your client’s insurance premium. If you have little leeway for negotiating the amount of the deductibles stipulated in your client’s contract, here are four crucial points to keep in mind when a syndicate of co-owners purchases or renews its insurance contract.

1. The claims history has an impact on the deductible amounts; encourage the syndicate to raise awareness of co-owners about the importance of properly maintaining their building and their units. Suggest a list of preventive measures to reduce the risk of damages, in particular water damage.

2. Syndicates must now have a self-insurance fund. Explain to your client that the highest deductible stipulated in the contract, with the exception of the deductible for earthquakes or floods, is the amount to contribute to the self-insurance fund [article in French only] as of April 15, 2022.

3. The amount of the deductible is a common expense that is apportioned among all the co-owners according to their share. To verify whether the deductible is reasonable, divide it by the number of units; this will enable you to establish the approximate amount that each unit would be required to assume and will allow you to see how it compares to the amount that a home insurance client would normally pay (approximately $500 to $1,000).

4. Do not forget to keep detailed notes of your discussions with the syndicate’s directors so that you have a record of what was discussed.

Finally, the syndicate must purchase insurance with a reasonable deductible that covers the building as a whole against the usual risks. The government may determine by regulation whether a deductible should be considered unreasonable; it has yet to invoke this power.

To find out more, read: An Overview of Deductibles for Syndicates of Co-ownership.

To find out more, read: An Overview of Deductibles for Syndicates of Co-ownership.

The self-insurance fund

The syndicate has an obligation to create a liquid, available on short notice, self-insurance fund 12 [article in French only] that is used to pay deductibles and repair syndicate property when the contingency fund or money from an insurance claim cannot do so.

This fund must be able to cover the highest deductible in the syndicate’s insurance contract, except for the deductible for earthquakes and flood coverage, if such coverage is included in the contract.13 However, the government provided the possibility for the syndicate to limit the capitalized contribution to a maximum of 100 000$.

The syndicate’s minimum contribution to the self-insurance fund is established every year when the amounts to be paid into the contingency fund are determined, and is calculated as follows14 :

| Amount held in the self-insurance fund | Amount to contribute during the fiscal year |

|---|---|

| 50% or less of the highest deductible* | 50% of the highest deductible |

| Over 50% of the highest deductible* | Difference between the fund’s capitalization and the amount of the highest deductible |

| Equal or higher than the highest deductible* | No obligation to contribute |

*The highest deductible excludes the deductible for earthquake and flood insurance if they are included in the contract. The syndicate can decide on limiting the self-insurance fund to an amount of 100 000$.

![]() Make sure to inform your clients about the amount of the deductible that they will be required to pay into the self-insurance fund as of April 15, 2022.

Make sure to inform your clients about the amount of the deductible that they will be required to pay into the self-insurance fund as of April 15, 2022.

Whether or not to claim

Even if a loss is covered by the syndicate’s insurance contract, for various reasons (amount of damages close to the deductible, multiple claims, etc.), some syndicates may choose not to file a claim for compensation with their insurer.

In order to make an informed decision, the syndicate’s board of directors might contact you, their agent or broker, to find out whether they should file a claim or not. At that point, you can explain to the syndicate what its obligations are, as well as the pros and cons of each option.

If, however, the syndicate “decides not to avail itself of the insurance, it shall with dispatch see that the damage caused to the insured property is repaired.”15 The syndicate will thus have to have the repairs done, except for those related to improvements to private portions. Furthermore, the repair costs incurred by the syndicate will then have to be apportioned among all the co-owners, as a common expense, according to their share.16 See “Bringing an action against a co-owner” below to learn more about actions the syndicate can bring against a co-owner who is deemed liable for the damages.

When a loss occurs: the adjuster’s role

Even if water damage occurs in only one of a building’s 15 units, the claim must be made under the syndicate’s insurance.17 Claims adjusters must therefore understand the legal obligations in order for them to properly inform all the parties involved in the settlement of the claim.

In particular, the claims adjuster must act quickly to investigate the claim, and identify its cause and origin, and the nature of the damages incurred.

The ChAD has created a Tip sheet on co-ownership to help claims adjusters fully meet their ethical obligations.

Can the syndicate demand that a co-owner who has been deemed liable for damages reimburse it for the amount it paid to repair the damages?

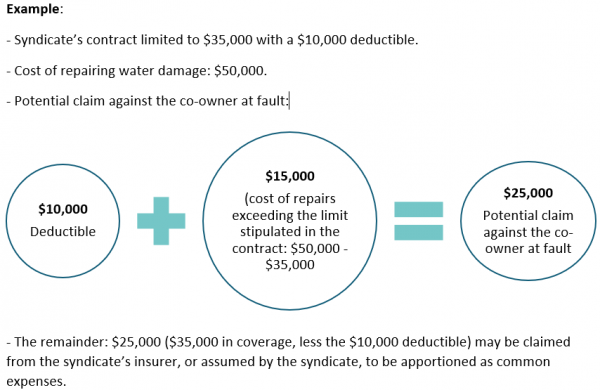

No, except for the amount of the deductible and the damages that exceed the amount of coverage stipulated in the syndicate’s insurance contract, or those not covered by the insurance. Under such circumstances, the co-owner would be obliged to make reparation for the injury caused by the co-owner’s fault or by the fault of another person or by the act of things in the co-owner’s custody 18.

The same applies to an insurer’s right of subrogation: it is prohibited to sue the syndicate, a co-owner, a person who is a member of the co-owner’s household, or a person in respect of whom the syndicate is required to enter into an insurance contract to cover the person’s liability.19 This means that an insurer cannot sue a person who is responsible for the damage if they are a member of the co-owner’s household. That said, the law provides for exceptions for bodily, or moral injury, or if the injury is due to an intentional or gross fault.20

Important

Claims adjusters must therefore evaluate the circumstances of the loss and conduct a proper investigation in order to gather all the details, or better yet, convincing evidence of an intentional or gross fault. Otherwise, it is uncertain the insurer would have a right of subrogation.

![]() Please feel free to contact Accent Déonto, at 541 842-2591, or info@chad.qc.ca if you have any further questions on your professional practice or your obligations.

Please feel free to contact Accent Déonto, at 541 842-2591, or info@chad.qc.ca if you have any further questions on your professional practice or your obligations.

[1] Section 19 of the Code of ethics of damage insurance representatives.

[2] Section 26 of the Code of ethics of damage insurance representatives.

[3] Section 3 Regulation to establish various measures in matters of divided co-ownership insurance.

[4] Section 4 Regulation to establish various measures in matters of divided co-ownership insurance.

[5] Article 1073 of the Civil Code of Québec.

[6] Section 1 Regulation to establish various measures in matters of divided co-ownership insurance.

[7] Article 1074.3 of the Civil Code of Québec.

[8] If there is no insurance, the insurer will compensate 90% of the assessment, and 100% if there is insufficient insurance; in both cases, compensation will not exceed the amount of insurance stipulated in the Extension of Coverage – Loss Assessment. The co-owner must pay the deductible.

[9] Section 37(6) of the Code of ethics of damage insurance representatives.

[10] Section 27 of the Act respecting the distribution of financial products and services.

[11] Sections 9 and 37(1) of the Code of ethics of damage insurance representatives.

[12] Article 1071.1 of the Civil Code of Québec.

[13] Section 2 of the Regulation to establish various measures in matters of divided co-ownership insurance.

[14] Regroupement des gestionnaires et copropriétaires du Québec, Projet de règlement sur les assurances en copropriété – document explicatif, [Draft regulation on co-ownership insurance, explanatory document, in French only] July 18, 2019.

[15] Article 1074.1 of the Civil Code of Québec.

[16] Article 1074.2 of the Civil Code of Québec.

[17] Article 1074.3 of the Civil Code of Québec.

[18] Articles 1074.2 and 1457 of the Civil Code of Québec.

Tool currently under revision

- Insurance checklist for syndicates of co-ownership

Important: This tool is currently under revision following the adoption in June 2018 of Bill 141, which amends articles in the Civil Code of Québec related to co-ownership.